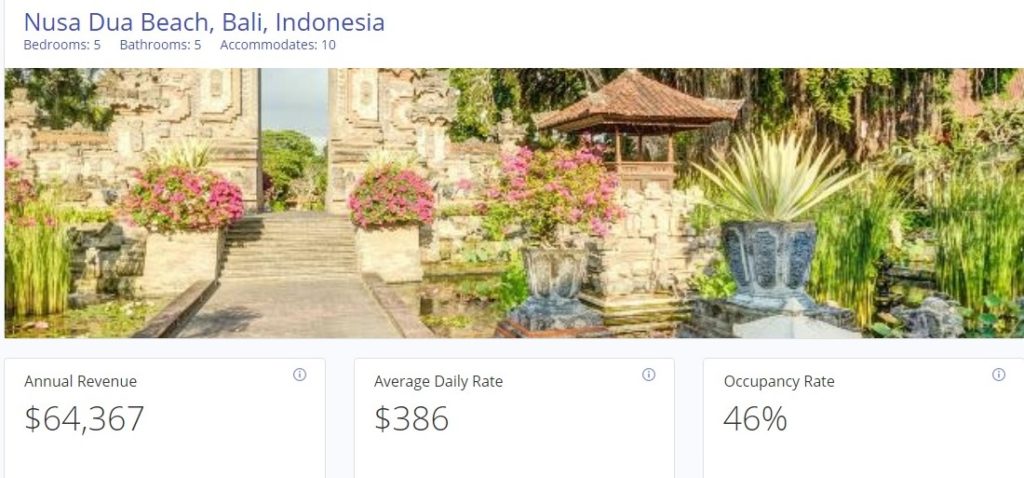

Let me know if this calculator makes sense and if you want me to add more fields.A recent report by, a vacation rental analytics company, indicates that average daily rates in Dubai are the 3rd highest in the world. Giving me some ideas on whether I should lower the price for higher occupancy rates or not, and whether buying this property is a good investment or not. The second image shows 85% occupancy rates and lower nightly price. The first image is the result of profit simulation with 75% occupancy rates and $92 nightly price. (So you can take a look at the codes behind too) So, I just made this one during my free time and published it as an open-source. There ISN'T any good calculator for short-term rentals. Some areas just have low nightly rates but housing prices were expensive and vice versa. Although the calculation wasn't accurate since I couldn't know their true occupancy rates, it allowed me to quickly identify what are the bad deals are. Then, wrote them in an excel, and see if they are making above 10% net rental yield. So, what I did was, whenever I found good houses to buy, I looked into Airbnb listings around that area to check their nightly price. Just wanted to drop a quick post to share a link to an Airbnb income calculator I've been working on that host here may find it useful.Ī few years ago, I was just getting started with property investment and tried finding out which houses will make the most profit on Airbnb.

0 kommentar(er)

0 kommentar(er)